Breaking Barriers to Fund Onboarding

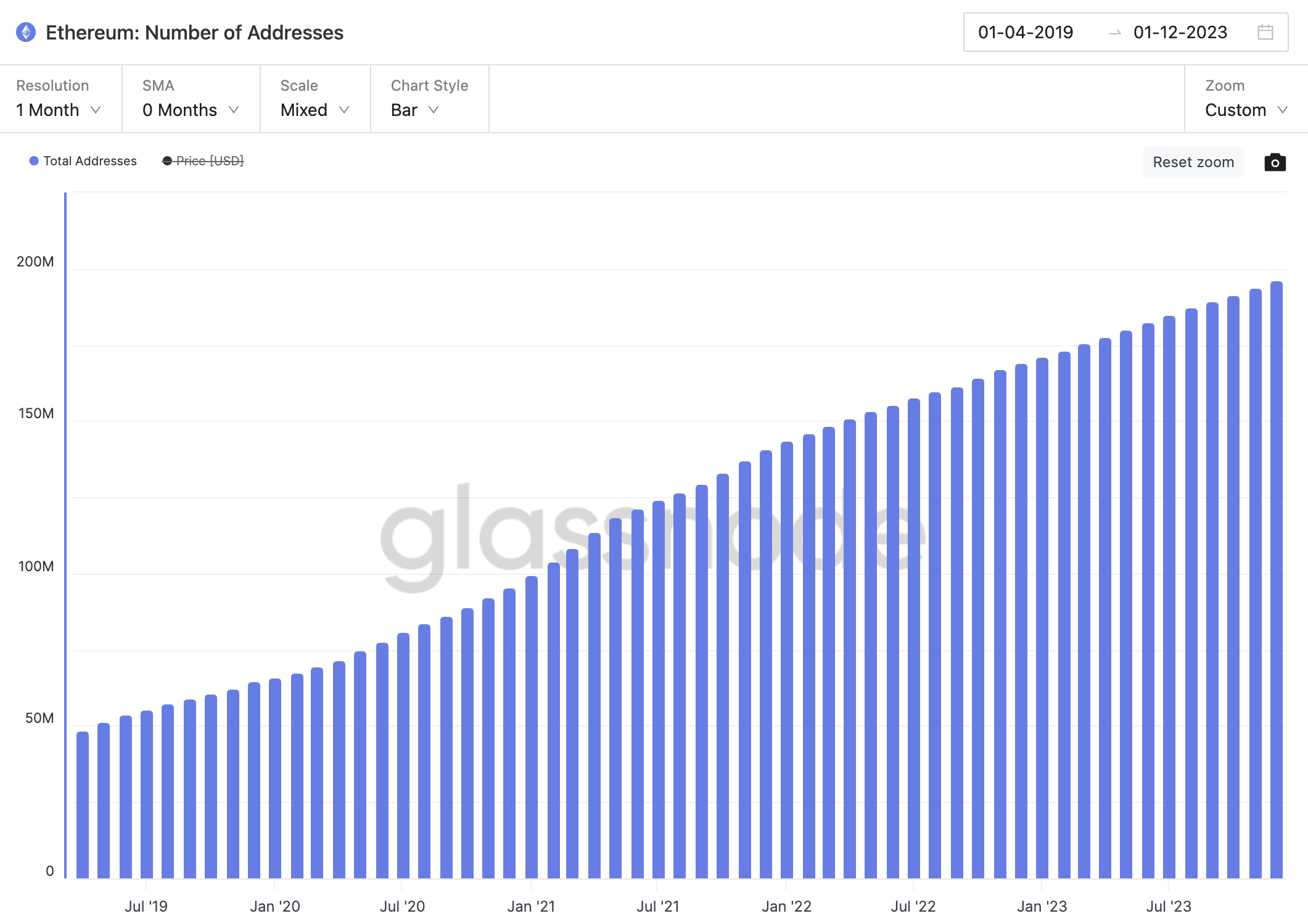

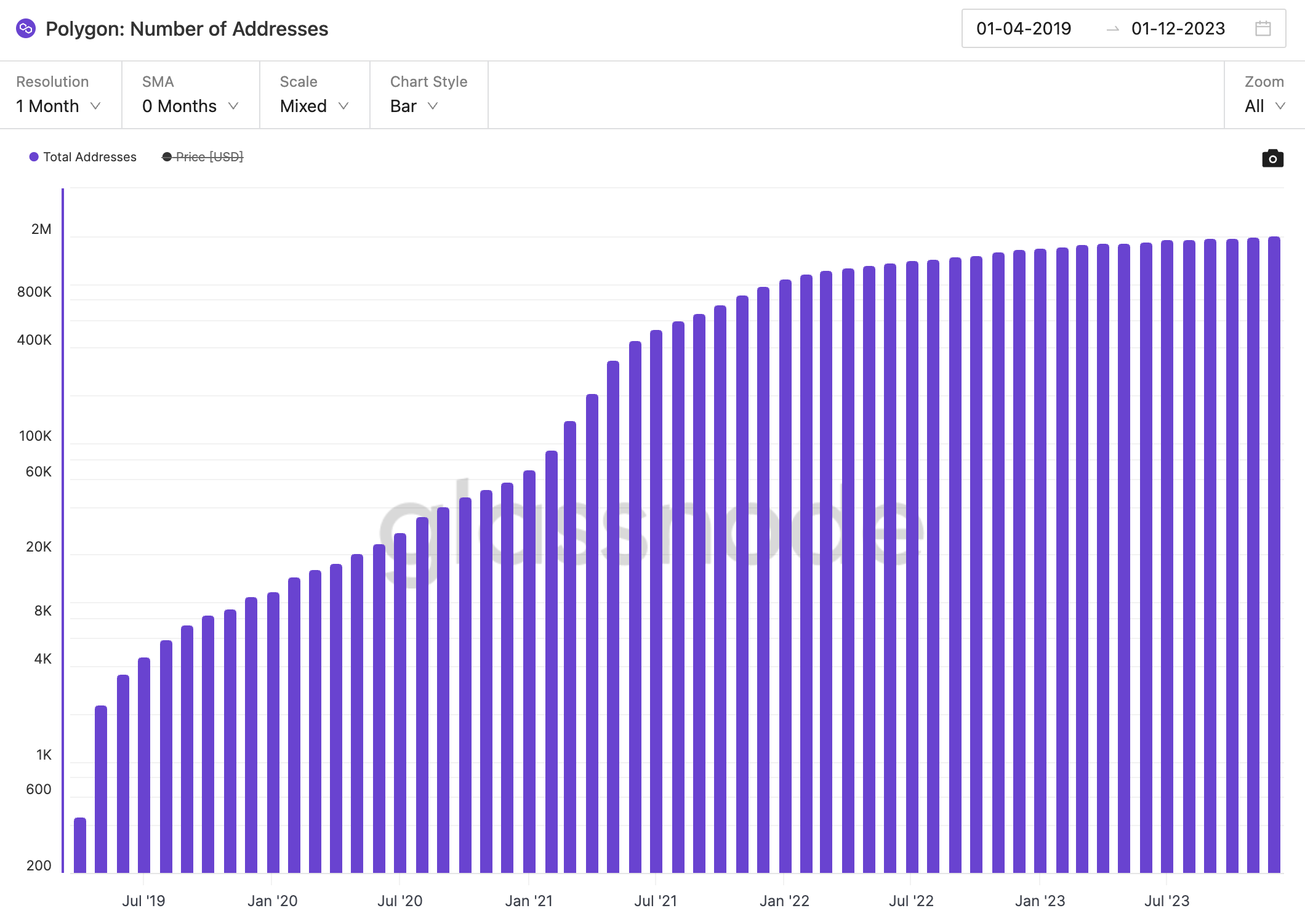

The adoption of Web3 technology has been remarkable, with many individuals incorporating cryptocurrencies and dapps into their daily lives. The growing number of Ethereum addresses being created indicates this trend. Since its introduction in 2015, the usage of Ethereum has expanded significantly, as demonstrated by the notable increase in Ethereum addresses, which has reached an all-time high (ATH).

A growing number of EoA addresses on Ethereum (left) and Polygon (right). Source: Glassnode

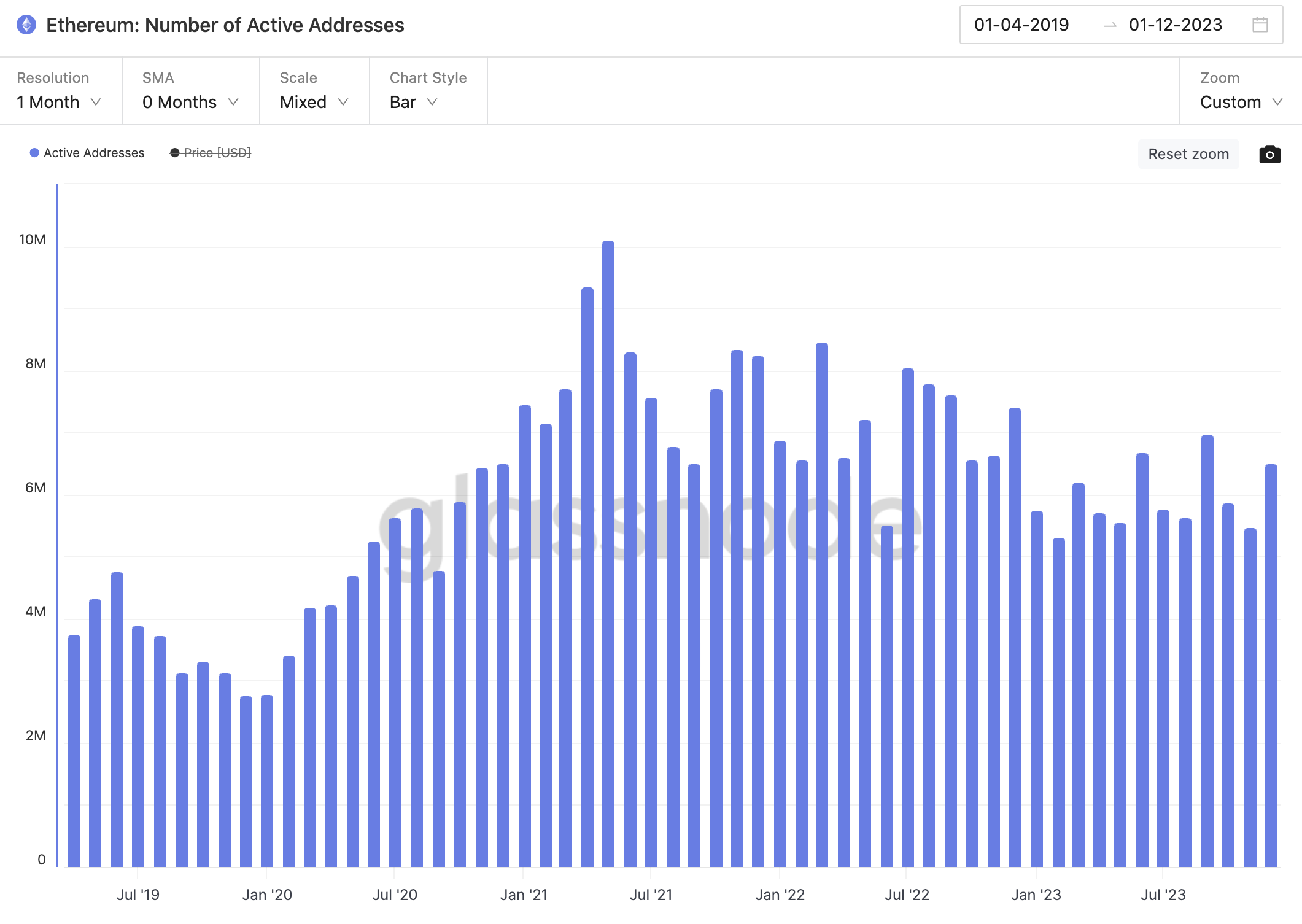

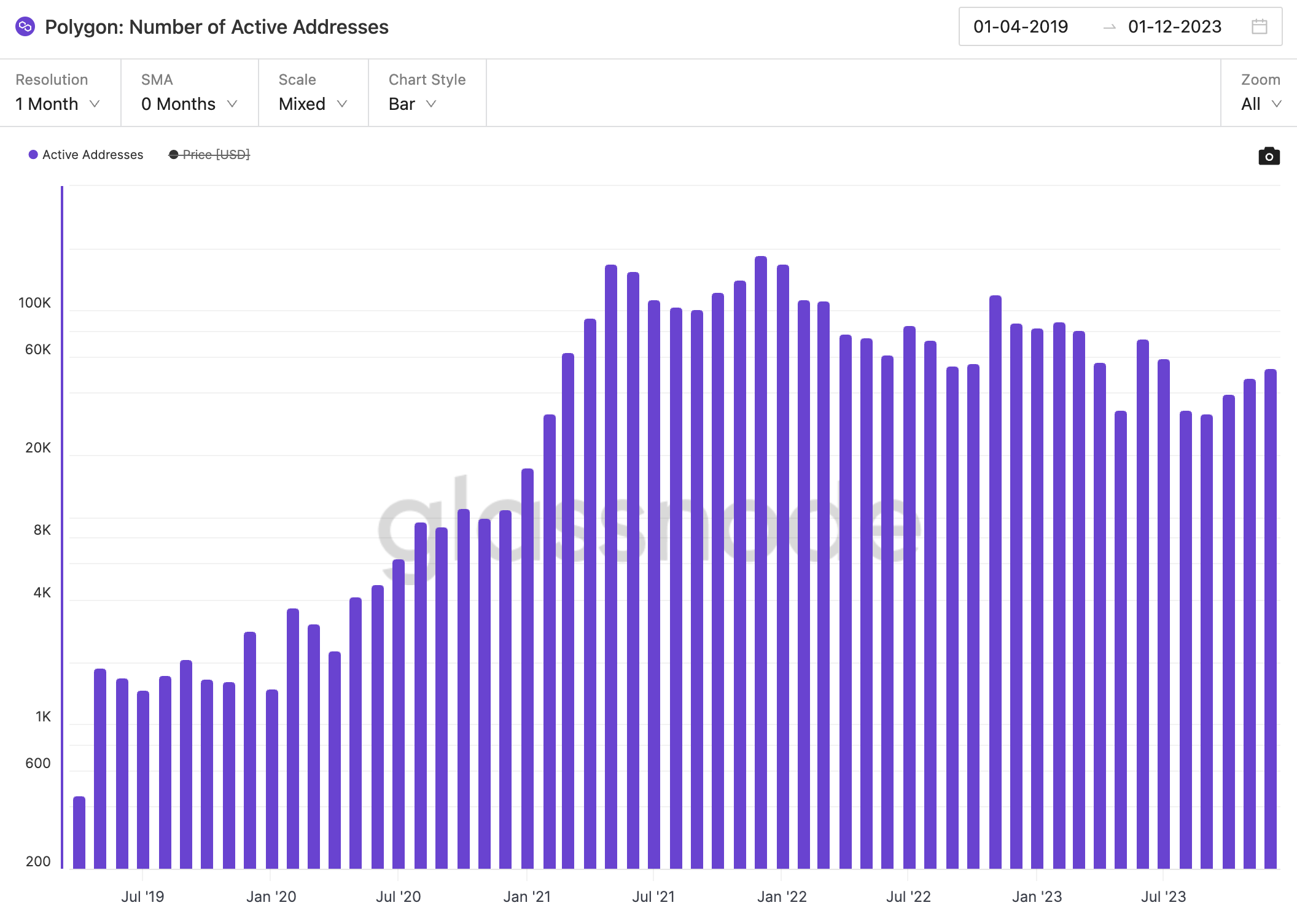

However, the complexity associated with accessing dapps and navigating blockchain networks remains a significant obstacle, impeding the wider adoption and acceptance of Web3. The graph below shows the trend in active wallet addresses (involved in successful transactions as senders or receivers), which is not linear.

There are noticeable fluctuations in the numbers. This suggests that although there is a strong interest in engaging with Web3 and accessing dapps, creating new wallets, the actual utilization is inconsistent. One potential reason for this inconsistency is the complexity of funding these newly created wallets. The intricate procedures for onboarding funds may cause users to hesitate or even abandon the wallet activation process.

Inconsistent trend of active EoA addresses on Ethereum (left) and Polygon (right). Source: Glassnode

Challenges in Today's Wallet Activation Landscape

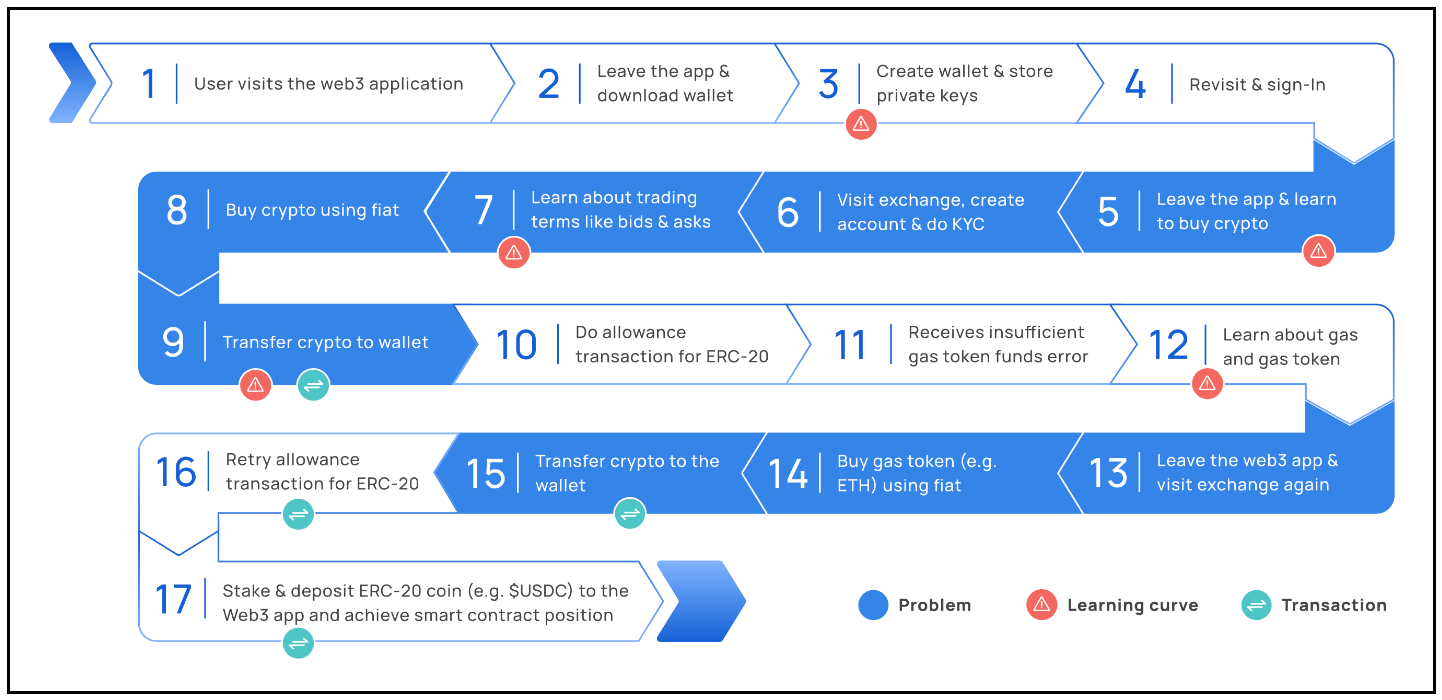

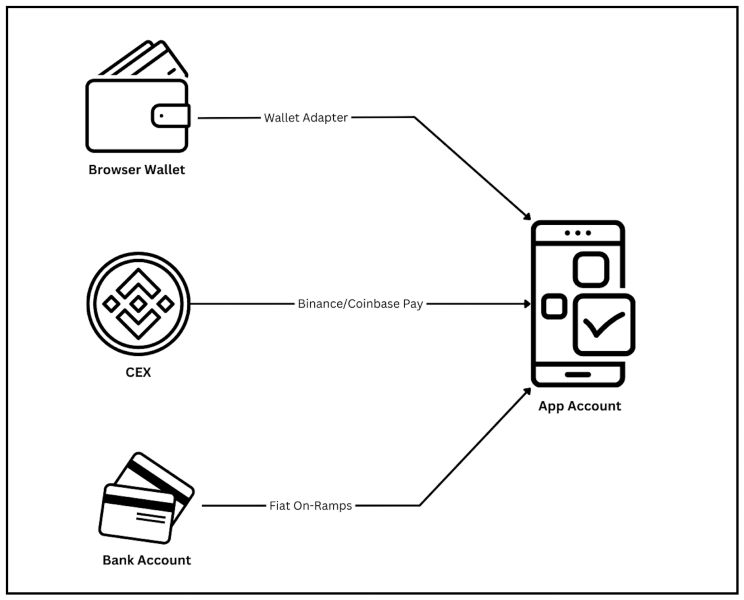

Funding the browser wallet (EoA) or Embedded wallets (smart accounts or MPC wallets) remains a consistent hurdle that prevents users from activating these accounts for subsequent transactions. Users today have various options for funding their new wallets, including using fiat onramp services or transferring assets from centralized exchanges (CEX) or Peer-to-Peer (P2P) payments.

However, each method has complexities and often involves time-consuming steps, negatively impacting the user experience. Now, let's explore the typical issues users face:

1.) Challenges in Transferring Assets from Exchanges

Users often start by buying assets on CEXs due to their user-friendly interfaces and easy access, especially for those new to the cryptocurrency space. CEXs offer the advantages of high liquidity and a wide variety of cryptocurrencies, making them an excellent option for acquiring digital assets.

However, transferring assets from Centralized Exchanges (CEXs) to wallets is not as straightforward as copying and pasting the wallet's receiving address and returning it to the CEX to paste it and select the correct network. This step is risky as errors can result in asset loss. Multiple confirmations and security checks further complicate the process, often leading to delays due to CEX processing times or network congestion. This can be particularly tedious and error-prone for Web3 newcomers.

b.) Limited Network Support: CEXs usually prioritize supporting blockchain networks with high user demand and trading volumes, leaving less popular networks behind due to the integration and maintenance costs. Transferring tokens to wallets on specialized chains, such as Layer 2 networks or app chains associated with emerging dApps, presents challenges. The introduction of Rollup-as-a-Service (RaaS) expands transactional capabilities for dApps but aggravates this issue, as many CEXs do not support these niche networks. This complicates asset transfers for users, especially beginners.

c.) Transaction Delays: While blockchain transactions are typically fast, they can be significantly slower on CEXs. Some smaller or lesser-known CEXs may batch transactions to save on fees, and some impose a 24-hour asset freeze, causing delays. New users may struggle to navigate these variations in transaction processing times, often unknowingly choosing exchanges with slower or more restrictive transaction policies.

d.) Withdrawal Restrictions: CEXs commonly impose minimum and maximum daily withdrawal limits, preventing users from transferring all their funds simultaneously. This requires users, especially those with significant holdings, to plan multiple transactions over several days to comply with these limits. This adds complexity and inconvenience to the withdrawal process.

2.) Gas Fee Complexity and Management

Navigating gas fees, especially for newcomers in the blockchain space, presents a significant challenge. This is particularly true on networks like Ethereum, where gas fees fluctuate based on network congestion. Incorrect gas fee estimation can result in two main issues: setting it too low may cause transaction failures, leading to delays and loss of the paid fee, while setting it too high incurs unnecessary financial expenses.

Transferring tokens to wallets on specialized chains, such as Layer 2 networks or appchains associated with emerging dApps gas fees, can be more daunting for beginners than the basic steps of funding a wallet or executing asset transfers. This complexity hampers their experience and discourages further participation in the Web3 ecosystem. To address this, an urgent need is to develop intuitive and user-friendly tools that simplify the estimation and management of transaction fees. Advanced solutions, such as automated gas fee adjustment systems or 'auto-bumping,' can dynamically modify gas fees to ensure efficient and cost-effective transaction confirmations, aligning with the user's requirements and current network conditions.

3.) Transfers to Incorrect Address

Transferring assets within the blockchain ecosystem, mainly when users move funds from Externally Owned Accounts (EOAs) or Centralized Exchanges (CEXs) to wallets of dApps, carries a significant risk of sending assets to the wrong address. An example of this risk is within the Bitcoin network, where Chainalysis reports that around 20% of Bitcoins are considered lost, with many being attributed to errors in address input.

5 minutes ago, a victim lost $1.04 million by copying the wrong address from a contaminated transfer history. pic.twitter.com/DDphtf3OY4

— Scam Sniffer | Web3 Anti-Scam (@realScamSniffer) February 9, 2024

To address this issue in the Ethereum network, EIP 55 was introduced. EIP 55 incorporates a checksum mechanism for Ethereum addresses, aiming to reduce the risk of errors during address input. The checksum works by capitalizing certain characters in the hexadecimal Ethereum address based on the address's hash, creating a recognizable and verifiable pattern. This adds a crucial error-checking layer to Ethereum transactions.

However, challenges remain despite the advantages of EIP 55. Not all wallets and interfaces uniformly adopt or enforce the checksum format, which leaves room for errors if users come across non-checksummed addresses. While the checksum significantly reduces typos, it does not verify an address's existence or specific blockchain. Therefore, users can still mistakenly send funds to non-existent addresses or addresses on an incorrect blockchain.

In conclusion, although EIP 55 significantly improves transaction accuracy on the Ethereum network, users must remain vigilant due to the ongoing risk of misdirected transactions.

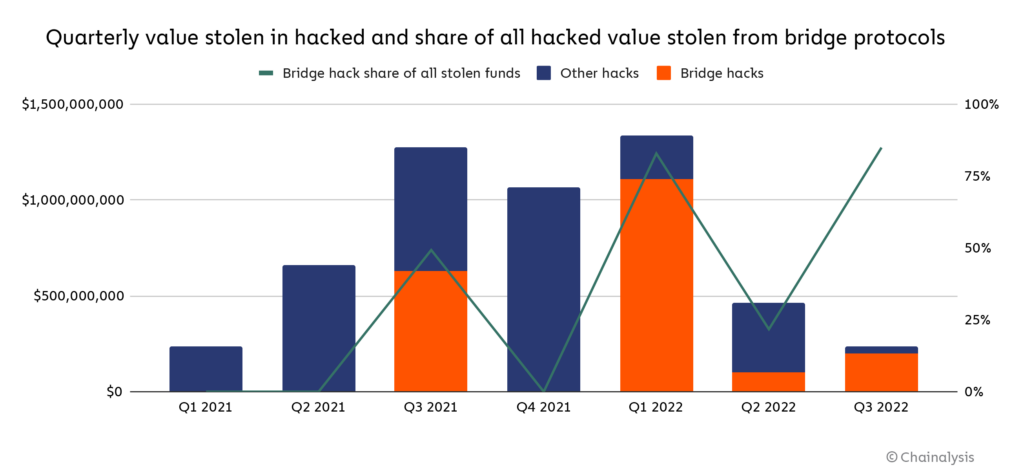

4.) Cross-Chain Transfers and Bridging

The importance of cross-chain asset transfer and bridging becomes evident when a user holds assets in their EOA and wants to interact with a dApp that operates on a different blockchain network. In such cases, the user needs to transfer funds to the embedded wallet of the dApp.

However, cross-chain transfer and bridging also come with several UX issues that affect users, especially those new to Web3:

- Complexity and Technical Knowledge: Cross-chain transactions require a higher level of technical understanding, particularly regarding liquidity. Users need to comprehend how different blockchain networks operate, which can be overwhelming for cryptocurrency newcomers.

- Integration with Wallets and Exchanges: The seamless integration of cross-chain functionality into existing wallets is still evolving. Currently, users often have to use multiple bridges to complete a transfer, which can be inconvenient and time-consuming.

- Inconsistent Confirmation Times: Blockchains have different transaction speeds. When bridging assets between chains, users may experience inconsistent transaction speeds and occasional delays in transaction confirmation. This can be confusing and frustrating.

Despite its challenges in user experience, cross-chain bridging is also vulnerable to various security risks, such as code vulnerabilities. Exploiting these vulnerabilities can result in unauthorized access and potential loss of assets for users during the transfer process. This security risk is not just theoretical; multiple high-profile incidents have targeted and successfully attacked cross-chain bridges, leading to significant losses.

5.) Nonce Settings and Transaction Queue

Proper nonce management is crucial when adding funds to a wallet, especially on EVM networks. The nonce is a sequential number that uniquely identifies each transaction and is essential for ensuring transactions are processed in the correct order.

Setting the nonce too high causes the network to wait for missing transactions to complete the sequence, leading to processing delays. Conversely, setting the nonce too low can result in the network rejecting the transaction as duplicates. This complexity increases when dealing with accounts that have multiple pending transactions, as it requires users to diligently track and assign the correct nonce values to ensure smooth transaction processing.

For newcomers to cryptocurrency or those with less experience, understanding and managing nonces can be challenging, potentially complicating the process of efficiently adding funds to their wallets.

6.) Multiple Asset Transfer :

When users need to fund their wallets, they often face difficulties transferring multiple assets, especially if they have a significant amount in an EOA. This can become impractical due to two main reasons:

- Gas costs for executing potentially multiple transactions can be high.

- Each transaction requires manual approval and signing.

The transaction process can become more complex and time-consuming for users with multi-signature wallets. These advanced wallets, designed for enhanced security, introduce additional steps and requirements that complicate asset transfers. While this is beneficial for preventing unauthorized access, users must coordinate and obtain signatures for even a single transaction. This can involve different EOAs or individuals. This prolongs transaction time and requires coordination, making the process technically cumbersome.

The user experience with MPC wallets for multi-asset transfers can be daunting and inefficient. These wallets are designed for heightened security through distributed key management but complicate the transaction process. Users face a complex procedure as each asset requires a distinct transaction sequence with fragmented key computations. This complexity is magnified by the need for sequential processing of transactions in MPC wallets, leading to delays, especially during high-volume sessions. The confirmation time is also extended due to intricate security protocols.

The risk of running out of gas further complicates multiple asset transfers. If a user runs out of gas during a transfer, they must acquire more gas tokens and add them to their EOA, adding extra complexity and inconvenience. This makes the onboarding process more cumbersome and time-consuming.

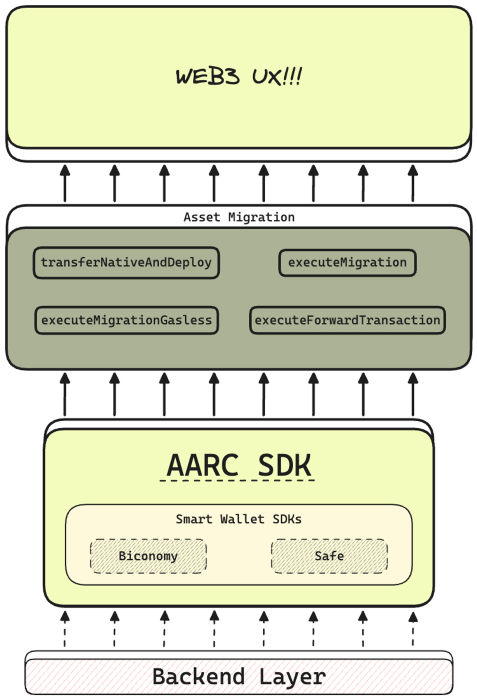

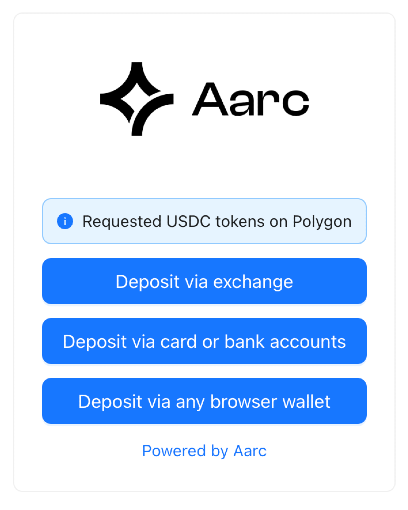

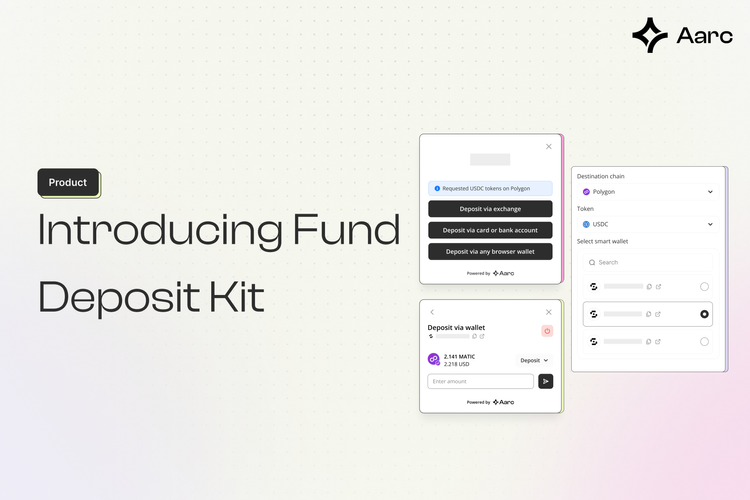

SAVIOUR: Aarc Fund Deposit Kit

Aarc recognized the challenges associated with funding wallets and decided to solve them. We have developed a toolkit consisting of an SDK, API, and Widget to simplify and enhance the process of depositing funds into smart wallets and embedded wallets. The Fund Deposit Kit, in particular, is an innovative solution that transforms the complex, multi-step deposit process into a straightforward, single-step experience.

The Aarc Fund Deposit Kit enables developers to facilitate the onboarding of funds from multiple funding routes in a single flow, providing a user-friendly experience without confusion. For web2 users, we offer onramps, while exchange users can directly use Coinbase and Binance Pay. Additionally, for Web3 users, we provide seamless cross-chain token transfers and swaps.

Let's delve deeper into the Fund Deposit Kit and explore the various efficient methods it offers for funding wallets in a single step:

1.) Deposits from User's Browser Wallet

Aarc's toolkit enables dApps to securely and quickly transfer assets from a user's browser-based wallet to embedded or smart accounts. This is done through connections established via Wallet Connect or similar wallet adapters, allowing seamless interaction between the user's wallet and the dApp. The transfer of assets from the user's Browser EOA can be done in the following ways:

- Cross-Chain and Cross-Token Deposits: The Fund Deposit Kit handles assets across different chains and tokens. It efficiently manages the swapping and bridging processes to deposit assets on the desired chain and token specified by the developer. The Smart API provides dynamic call data to determine the available cross-chain route for the best and fastest experience.

- Cascaded Signatures and Batching: The fund deposit kit allows developers to cascade multiple EIP712 signatures, simplifying the process for the end user. It enables users to initiate all transactions together instead of separately. Alternatively, the SDK also supports transaction batching through the permit2() contract by Uniswap. This functionality allows users to transfer multiple assets from one address to another with a single click. It also lets users deposit tokens from an EOA to embedded and smart wallets in a single flow, provided the tokens have already been permit2() approved.

- Gasless Deposits: Aarc's SDK offers a user-friendly feature for handling gas fees, eliminating the need for users to possess native tokens. Users can pay gas fees with widely used ERC20 tokens such as USDC, USDT, or wETH. Additionally, Aarc's SDK allows dApps to optionally cover the cost of gas fees for their users, simplifying the fund onboarding process. Aarc leverages EIP 2771 for streamlined, gasless transactions. In this framework, users sign and pass the off-chain transaction message to relayers. These relayers handle the gas fees and ensure optimal gas fees for each transaction. They also detect congestion and gradually increase gas fees if needed. This ensures users do not experience stuck transactions and receive transaction confirmations at the best gas price.

2.) Onboard from Centralized Exchange:

Aarc simplifies the transfer of funds from Centralized Exchanges (CEXs) to embedded wallets in dApps. Users can authenticate their CEX accounts (Binance and Coinbase) directly within the dApp interface. This integration allows for a seamless, one-step transfer of funds from CEX accounts to embedded wallets within the same UI, eliminating the need to switch between platforms.

Furthermore, Aarc effectively addresses the issue of CEXs not supporting transfers on specific networks. With its cross-chain and bridging capabilities, Aarc enables users to move their assets from CEXs to any network, regardless of compatibility constraints. This approach dramatically simplifies the process, eliminating the need for manual address copying, repeated verifications, and the hassle of checking network compatibility and limitations.

3.) Onboard with Credit/Debit Card:

Aarc's SDK allows dApp users to deposit the required tokens directly into their wallets by purchasing them with a Credit/Debit Card.

Under the hood, Aarc utilizes third-party onramp services. Transak is a toolkit that enables apps to onboard their users, allowing them to buy crypto directly from fiat methods and have the funds deposited directly into their wallets.

Curious about experiencing Fund Deposit Kit and its offerings? We've got you covered! You can explore our interactive demo or watch the demo video to get a feel for what we offer.

Why Fund Deposit Kit is simply unmatched ✨

The Fund Deposit Kit stands out from the rest, taking Devx to another level:

- Go to market in less than 30 min: By consolidating all funding flows (EOA, CEX, Fiat) into a single kit, there is no need for multiple vendor integrations. This streamlines the market entry process for developers to just 30 minutes, the time required to integrate our user-friendly customizable widget.

- Uncompromised Security: Our approach eliminates the need for trust or security assumptions. We do not hold or take custody of Aarc at any stage, nor do we require approvals. We only utilize the permissions for contract approvals through Uniswap's permit2 function.

- Flexible Modular Suite: Tailored to meet specific needs, the Kit allows for customization of precise flows in both product and user experience. Dapps looking to transition from EoA to Smart accounts can select that feature, bypassing the need to integrate the entire suite.

- Tech Stack Independent: Fund Deposit Kit is designed as an API-first product, ensuring compatibility across various client frameworks, including React, Vue, mobile web, Flutter, and more.

Aarc's Potential Use Cases

The Fund Deposit Kit by Aarc has a wide range of applications:

- Smart Account Onboarding: Aarc simplifies transferring funds to newly created Smart Contract Wallets (SCWs). It offers a one-stop solution for asset transfer, supporting various sources such as direct transfers from CEX or browser-based EOA. Aarc also enables users to purchase cryptocurrency with fiat money and deposit it directly into their SCWs, making it easier for new and experienced users.

- Savings Apps and Vaults: Aarc revolutionizes financial savings and portfolio management in Web3. It offers a seamless and simplified fund onboarding experience for savings dapps and vaults. Users can transfer funds into savings vaults and crypto portfolio apps directly from CEX or other wallets or by depositing fiat into on-chain savings and portfolio management.

- CEX and Trading Platforms: Aarc's SDK provides a straightforward solution for depositing funds into 1 Click Trading (1CT) wallets. Users can seamlessly transfer funds into their 1CT wallets directly from CEX or their browser wallet in a simplified step. This eliminates the need for multiple manual signatures and improves the user experience.

Looking to streamline the deposit process for your users and seamlessly onboard web2 users? Get Started from here.

If you are as excited about this future as we are, we want to hear from you. Reach out to us via Twitter. If you have any inquiries about integrating with us, please book a meeting with our team!

Member discussion